Let’s say that someone found gold in the middle of the Sahara and apparently, that soil is quite fertile with gold. And let’s say, there is no rule (yet) stating who is permitted or not permitted to mine it.

Isn’t this sound like a great opportunity? Indeed.

Wouldn’t you want to capitalize on that? Surely.

Does that mean I need to be the first to mine it to get the most gold? Not necessarily, it depends on which part of the soil.

The above is a simplified analogy befitting the current market trend, in which we are seeing a trend of new entrants potentially capitalizing on the share of incumbents.

The trend here isn’t about some NFT projects, rather, it is about the powerhouse of NFTs i.e. the NFT marketplace.

Despite the declining interest in NFT in the past two months, the fact that a new player in the marketplace space is able to overtake the incumbent, in this case, OpenSea, is bizarre.

Hold On, What’s OpenSea?

OpenSea, which has been widely associated with NFT, is a marketplace for the purchase & selling of NFTs. The fact that OpenSea branding is closely tied to NFT has trickled down to show in its market share & revenue.

Basically, what this means is that OpenSea has been dominating the NFT marketplace with a strong bottom financial (Revenue from fees accumulated up to $2.46 billion with a total transaction volume of $32.5 billion).

That is pretty amazing (not just amazing, it is insane) for a company that has only been launched for about 4 years plus (since Dec 2017) and with a price tag of $13 billion valuation after OpenSea raised its Series C this year. (Series C is a funding round)

Just a side-by-side comparison, for Apple to get to that level of revenue, it took them 23 years. Yes, that long.

It sounds like OpenSea is quite solid, financially on paper and in terms of funding backing. However, perhaps there is more to the story and that we are looking through rose-tinted glasses, neglecting the overall bigger picture.

Let’s dig in!

So…, What Happened?

New entrants namely LooksRare & X2Y2 which were launched in early 2022 are trying to gain market share from OpenSea.

Basically, they are trying to kick OpenSea’s ass.

Chart 1: NFT Volume Transaction with Wash Trading

In a few instances this year, we can see that LooksRare & X2Y2 have surpassed OpenSea’s volume transaction from the above chart. LooksRare has managed to exceed OpenSea’s volume by more than twofold early this year and the impact was obvious until May/June set in, which at that time, the NFT interest was declining.

Interestingly enough, despite the crypto space deeply entrenched in the crypto winter impact, X2Y2 was, at least from the chart above, seemingly unaffected. In fact, the power play by X2Y2 was shown to be quite effective in suppressing OpenSea’s volume at the expense of its own gain.

This is akin to the Web2 power play between the social media platforms, with the latecomer Facebook (launched in 2004) ousting Friendster (launched in 2003 and eventually died in 2006) & Myspace (launched in 2003 till 2007, losing to the rising site Facebook).

Perhaps the first mover advantage isn’t really an advantage after all.

Really? So… OpenSea will cease to be the NFT marketplace leader?

LooksRare & X2Y2 are not the first, and perhaps will not be the last, to challenge OpenSea. In fact, there were many before them.

The fact that LooksRare & X2Y2 were launched this year and has managed to challenge OpenSea is worth looking into.

However, as great, as things look on the surface for the two latecomers, there are two sides to the story.

As important as volume/transaction is to the marketplace, another essential criterion is the number of users.

Chart 2: Number of users for Top 6 NFT marketplaces

Visualization of the number of users for the top 6 NFT marketplaces from Nansen.ai (data as of 29th July 2022) OpenSea, in comparison, still garners the most users and in fact, its trend seems to be stable. Despite the declining trend since Feb’22, the numbers of users are still on the higher side compared to its 2021 numbers.

While LooksRare seems to not be able to gain consistent users, X2Y2 on the other hand has been getting stronger in the past months in attracting users.

The impact of wash trading on the volume of transactions may be bigger than it seems.

Chart 3: NFT Volume Transaction without Wash Trading

Visualization of volume transaction for NFT marketplaces from Nansen.ai (w/o wash trading - data as of 29th July 2022) What is worth noting is that the data shown in the previous chart (Chart 1) indicates a totality of transactions, which includes wash trading whereas the above chart filtered out the wash trading transactions. Hold on, what is wash trading? Wash trading indicates multiple transactions of the same NFT between two wallets (which means fake transactions) and if this is taken into consideration, we will see vastly different perspectives in the volume transactions. The high volume that came from LooksRare & X2Y2 in early 2022 and in June 2022 respectively were actually from the wash trading. This indicates OpenSea is still relatively stronger in volume transactions.

As much as I would love to see more competition in the NFT marketplace space (as we know, more competition = better output for users), I have to admit that the domination is largely in the hands of OpenSea.

But, the twist here is that perhaps what LooksRare & X2Y2 have to offer can cater to the need of the crypto community.

For this, I will be dissecting them into 4 segments - community, investor, financial & technology to look beyond the achievement of the platforms and tap into these aspects of the marketplaces to understand how they may or may not cater to the crypto community.

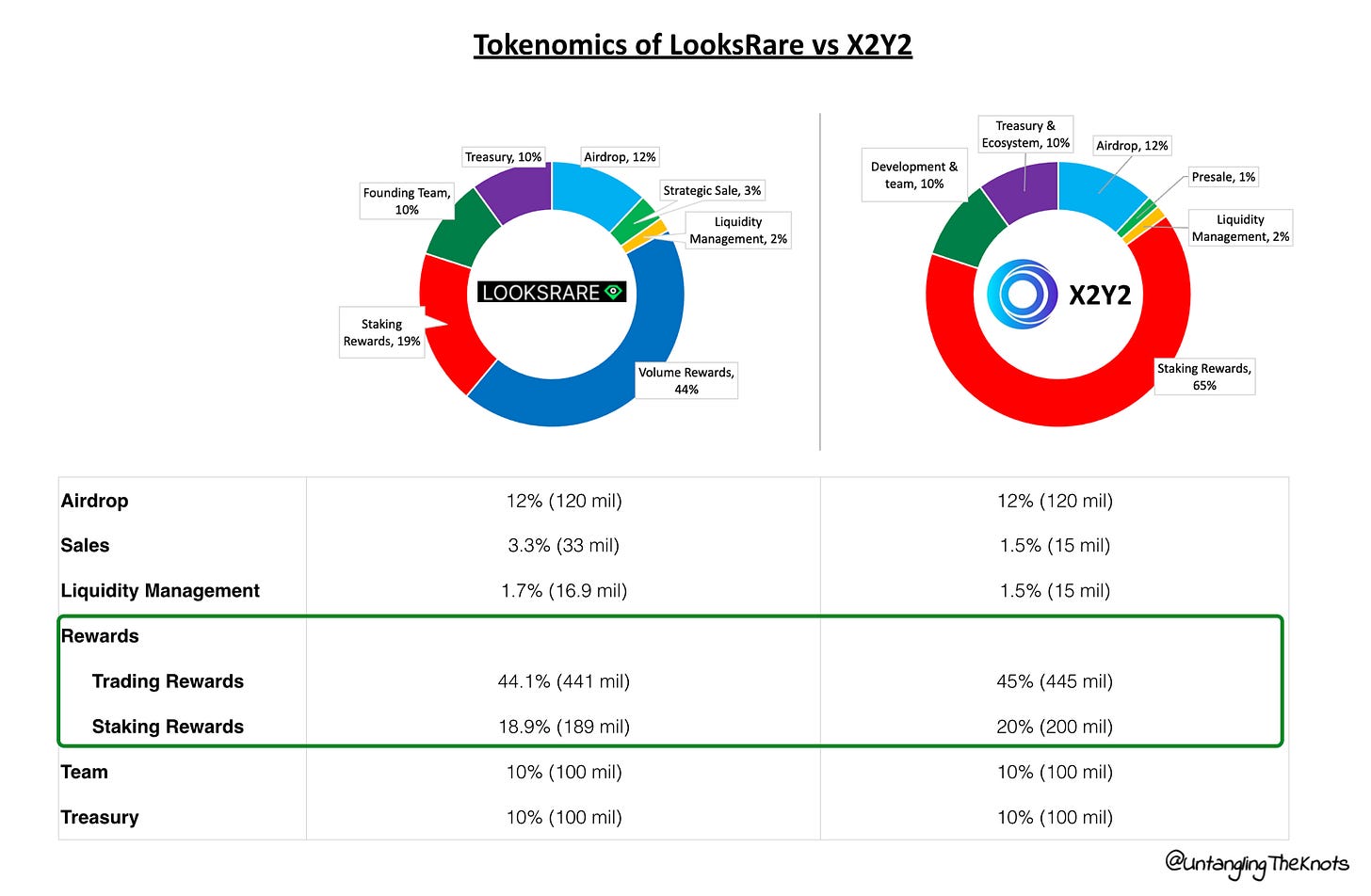

Given that both LooksRare & X2Y2 go towards the path of issuing tokens, it’s important to see how both tokens work, in short, the tokenomics. (Read more on tokenomics here)

There are no huge differences in the token distribution for LooksRare and X2Y2 apart from the sales & liquidity management portion. What is obvious with both platforms is the heavy focus on the reward system for users.

Trading Rewards is for the users who trade on their platforms (users who list, buy & sell NFT on their platforms)

Staking Rewards will be a future reward system for users who hold onto the token

Over-reliance on the reward system to get users onboard and try their platform is often time the chicken-and-egg scenario, especially for companies in their early stage, and with a 10% allocation in the treasury fund, it will be interesting to see how both platforms utilize that.

OpenSea's clear domination amongst the NFT marketplaces, its intention to go public (IPO listing), and its not-so-community-centric approach do not sit well among the crypto community, given that the crypto community has been advocating decentralization & a community-first approach.

That said, the key learning from the social media power play in the early 2000s may give a good view that early domination may not indicate the output as there are many external factors or circumstances that come to play.

Beyond the reward system & domination of the market, the uncertainty that comes from the market in its early stage may pose some real threats to not just OpenSea, but LooksRare and X2Y2 as well:

Possibilities that the NFT projects, especially those large projects, will start their very own marketplaces like CryptoPunks.

Ever-changing NFT trends. For example, NFT PFP was trending but right now, 1/1 or Generative Arts (Generative Arts indicates one of the kind arts, rather than the profile photo avatar NFTs) is the current trend, with ArtBlocks dominating. How can a marketplace ensure domination while not missing out on the latest trend?

With the evolving and fast-paced changes happening in the crypto space, how will this eventually turn out to be? Will any of these three turn out to be the final dominator in the NFT marketplaces or will there be a newcomer who will come in to disrupt this competition?

Whitepaper source: OpenSea, LooksRare, X2Y2

Data Analytics source: Dune Analytics, Nansen.ai

(whitepaper is a document that explained the technology & the purpose of a crypto project)

TLDR:

NFT space is akin to a gold mine, a lucrative space with insane valuation. With gold readily for mining, the most money-making space would be the gold miner company, in this case, an NFT marketplace.

OpenSea was and has been largely tied to NFT. In short, they have been dominating the market since its launch at the end of 2017. However, recently, in early 2022, we have seen two newcomers with the intention of changing the way NFT transaction works.

As threatening the media make of these newcomers, with the headline literally saying “X2Y2 overtaking OpenSea”, it is more than that.

The lack of users and high volume of wash trading deterred X2Y2 and LooksRare from showing a true threatening competitive side despite the features they rolled out are nothing but a great improvement.

The key differences between OpenSea vs X2Y2 and LooksRare

Caveats for NFT marketplaces

So, perhaps, only time can tell how this competition turns out to be and what may happen in the future.

Moving forward, Untangling The Knots will be focusing on three key areas:

Beginner-centric content like most of Untangling The Knots articles

Research/Data heavy analysis like the Crypto winter article and this article

Other contents styles which may touch upon perspective, thoughts, learnings

Beginner-friendly content is still, nonetheless, a priority of mine to ensure that everyone who reads will be able to derive their own understanding & learning in order to move forward in their crypto journey.

With that said, I thank you for reading my humble publication, and please help to spread the word if you enjoyed reading my articles.